Facebook ad costs for most online businesses will be the single biggest business expense you’ll ever come across. To give you an idea, we have an online store that does around R2 million in revenue per month.

On that store, our advertising costs on Facebook easily surpass 25% of that (Over R400,000) so it’s extremely important for us to be able to claim VAT back on that R400,000 ad spend to remain competitive otherwise we would be losing out on R60,000 every month!

So can you claim VAT back on your Facebook ad spend?

You can claim VAT on Facebook ads because Facebook charges 15% VAT in South Africa for both personal and business-related advertising spend whether you’re VAT registered or not since May 1, 2019. If your business is VAT registered you’ll need to insert your VAT-ID into your ad account to be able to claim the VAT back from SARS. If you’re not VAT registered, won’t be able to claim back the 15% you pay in VAT.

This isn’t ideal if you’re a smaller company that’s not VAT registered. Since everyone is forced to pay VAT on your FB ad spend your larger VAT registered companies will in a sense get cheaper ad costs than non VAT registered companies…15% cheaper to be exact.

So if you’re a small business that’s planning on spending a ton of money on Facebook ads then it might be time to look into getting VAT registered.

If your business is VAT registered but you’re not sure where to insert your VAT I.D then make sure you keep reading. I’ll cover that next.

How To Add a VAT Number Into Your Facebook Ad Account in South Africa?

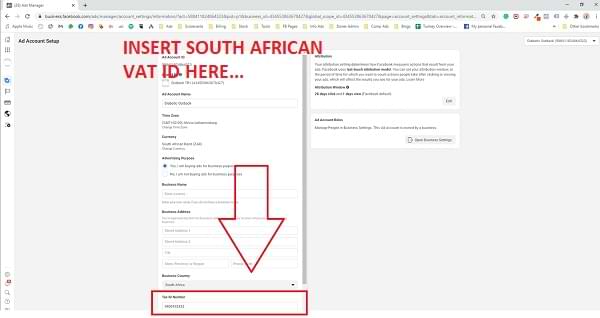

You can add your South Africa VAT ID to your Facebook ad account by navigating to the ‘ad account settings’ section.

Here’s how you can find your ad account settings:

- First, log in to your Facebook Advertising Account.

- Once you’re on the dashboard, click on the ‘business tools’ icon at the top left of your screen.

- Then click on ‘ad account settings’

- Now scroll down and insert your VAT I.D under the ‘Tax ID Number”

Here’s a video if you need a more visual guide.

That’s all you need to do. While you’re on the ad account setup page make sure that all your business details have been inserted correctly such as Business name and address etc.

How To Get a VAT Invoice From Facebook in South Africa?

You can get your South African VAT invoice in the ‘billing’ section of your Facebook ads account. Navigate there by logging in to your ad account, then click on the ‘business tools’ button on the top left of your screen, then click on the ‘billing’ menu options under the shortcuts section.

Once you’re in the billing section you’ll be able to view all your invoices for different dates. If you would like a more visual guide then make sure you watch the video below.

An important note. If you don’t see your VAT number on your invoice then it means you haven’t inserted your VAT number in your ad account settings. Revisits the second sub-heading in this article to learn how to insert your VAT details into your Facebook ad account.

What If You’re Trying to Claim VAT On Invoices That Don’t Have Your VAT ID?

Unfortunately, you can’t add your VAT number to past invoices. Once you update your VAT details it will only reflect in future invoices.

So if you forgot to insert your VAT details and you’re trying to claim back the VAT for the previous there then I highly recommend you chat to your accountant.

Technically you should be able to claim the VAT back since FB charges you VAT whether you insert your VAT ID or not. It might be a matter of proving that FB charged you VAT which is relatively easy to do. On the invoice you receive you’ll show an added 15% to your total ad costs. This 15% reflects the VAT amount you paid.

Just make sure you don’t try to claim VAT on your ad spend before May 1, 2019, because FB only started charging VAT after that date. If you do and SARS audits you there will be no way of proving that FB charged you VAT, because…well they didn’t…

Your Turn

Did you find this information useful? Or do you feel like I missed something important? Please make sure you let me know in the comments so we can start learning from each other.