I was browsing through the FNB App a few days ago, and I stumbled across this cool feature that allows you to check your FNB (First National Bank) credit score. The best part? It’s completely free, easily accessible, and it pulls all your financial data from the credit bureau in South Africa, so it’s always updated.

Here’s where you can view your FNB credit score on the FNB Mobile Banking app:

- Log in to your FNB mobile app

- On the top left of your screen tap on the hamburger ‘menu’

- Scroll down and tap on ‘nav-igate life’

- Tap on the ‘Money’ tab

- Finally, tap on the ‘Credit status’ tab

- You might need to approve the terms and conditions of this is your first time using this feature.

- You’ll now see your personal ‘credit status’

Once you’re in, you’ll notice that your credit status is displayed on a line that ranges from red to green. If you’re wondering exactly what this information means to you, then keep reading. I’ll cover that next.

Your FNB Credit Status Fully Explained

As a quick introduction, the FNB credit status report lets you know how likely you are to receive credit from FNB.

FNB sources the last two years of your financial data from credit bureaus in South Africa, coupled with any other financial data FNB can obtain when deciding your final score.

While you don’t exactly get a credit score number that we’re used to seeing from companies like Experian and Transunion, it’s worth assuming that your final FNB credit status also applies to how likely other banks and lenders in the country will give you credit. Which makes it a handy and free credit status tool.

Once you’ve logged into the tool you’ll first see a colourful measuring line that gauges your over-all FNB credit status from left to right.

The gauge ranges from red at the left, “Needs work,” to dark green at the right “You’ve got this.” Your current score will be shown by a little blue marker somewhere in between.

What I find really interesting and helpful is the information under this line.

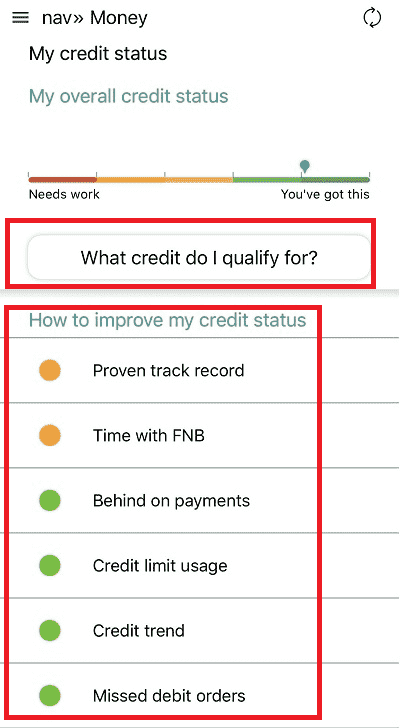

‘What credit do I qualify for?’ button.

You’ll notice there’s a button ‘What credit do I qualify for?’ Tap on it. Once in it will show you different credit options, for example, personal loans, credit cars, and home loans, along with a circle around each one that indicates how likely you are to get approved for each one.

This is helpful information because applying for credit can hurt your credit score. So we can use this information to decide if it’s worth applying for credit in the first place. If you’re unlikely to get credit then rather work on improving your overall credit score first before applying for more credit.

That moves me on to the next amazing little feature that this credit status tool can help with.

- Hit the ‘back’ button to go back to the main screen.

- And view under the ‘How to improve my credit status.’

‘How to improve my credit status’ section.

In this home section, FNB not only tells you how you can improve your credit status, but they actually give you a score illustrated by a little coloured circle on the left of every single scoring factor.

This tells you exactly what area you need to work on to improve financial decisions, and ultimately your credit status.

In the next sub-heading, I’ll go through every single one of these factors and I’ll explain how you can improve your score on that specific factor.

How To Improve Your Credit Status With FNB

If your overall FNB credit status is low, then I suggest focusing on the few factors that have a bad rating. All your credit status factors should at-least be green, if not, then dive into each one and find out how you can improve them.

Here are the factors that FNB looks at when deciding on your credit status.

Proven credit track record.

If you’ve never used credit before, or if you’ve abused credit, then your score will be negatively affected here. As far as I’m aware, they look at the last 24 months of bureau records.

How to fix it: Use more credit and use it responsibly. The more credit you have, and the better you manage it, the more likely you’ll get credit in the future.

Your time with FNB is also taken into consideration.

This one is pretty simple. The longer you bank with FNB, the more likely they’ll offer you credit.

How to fix it: Stay with FNB for longer.

Behind on payments?

If you’ve been behind on payments in the last 24 months then it never looks good to any financial institutions. They want to lend money to people with as little risk as possible.

How to fix it: Catch up on your payments and stay caught up for 24 months. Once this period passes, your colour grade will go to green which will improve your over-all score.

Credit limit usage.

The more credit you use compared to your total available credit, the more it will hurt your credit score. According to Arkali, principal scientist for FICO, people with a credit score of 800—which is in the dark green zone—uses only around 7% of their available credit.

How to fix it: Use less credit and try to stick to the 7% rule. If you have to use more, don’t go anything over 30%. And if you can, pay off all your credit on time at the end of each month.

Your credit trend.

FNB also looks at how quickly you’re taking on credit. The faster you take on credit, the less likely you’ll be able to pay it back, which means the more of a risk you’ll be. According to FNB, they compare the last two quarters, which is the last 6 months of financial data.

How to fix it: Do not take on more credit too quickly.

Missed debit orders.

Another straight forward one. The more debit orders you missed because of insufficient funds, the more FNB and other lenders will see you as a risk.

How to fix it: Make sure you have enough money in your main bank account to at-least cover any debit orders that will be going off your account.

Savings on hand.

All lenders will look at how much cash you have on hand as a backup. Quite simply put, the more cash you have, the more lenders will be willing to loan you more money because you’re much less of a risk. FNB will look at your savings across all your bank accounts.

How to fix it: Start saving as much as possible. The more savings you accumulate, the better credit score youll receive.

Final Thoughts

While the FNB credit status tool doesn’t exactly give you a credit score number that we’re used to, I actually find it a lot more helpful.

The credit score we’re used to receiving in number form that you can find on platforms like Transunion doesn’t pinpoint where you’re going wrong, the number just lets you know if you’re likely to get credit.

While on the other hand, the FNB credit status report colour grades every single grading factor separately that affects your overall score. This gives you the guidance you need to pinpoint exactly what you need to be working on to improve, which ultimately results in better financial decisions and a better credit score.

YOUR TURN: Do you think I missed something important in the article? Or do you know of any other free credit status tools that work better than this one? Let us know in the comments below so we can start helping each other out.

The tools that you use are great, but I would like to know is. On the circles that sows credit cards , home loans and over drafts, what percentage on the circle will tell you if you qualify for a home loan. or what score at Experian will tell you that you will qualify for a home loan.