I really wish major banks like FNB (First National Bank) would improve on their online tutorials. I tried to buy shares through the FNB online banking platform a few days ago and finding the right menu option to use share investor was pretty tricky.

If you’re stuck in this same dilemma, I decided to create a tutorial myself that will walk you through how you can buy shares through:

- FNB’s online banking platform.

- FNB’s mobile banking app.

Before buying shares on FNB’s online banking share investor account, you need to:

- Make sure you have online banking for your FNB profile setup. Including your FNB mobile app if you would like to buy shares through there instead. View this guide on how to register for FNB online banking.

- Create a “Share Investor” account. You’ll also need to open a share investor account within your banking profile. You should be able to do this on your online banking profile, however, if you struggle, simply contact FNB customer support or let me know in the comments below.

- Fund your “Share Investor” account. Finally, You need to make sure you have funded your investment account. To do this, simply click on the “transfer” tab on the main screen of your online banking profile, then transfer funds from an account that has money, into your “Share Investor” account. These funds will reflect immediately.

Once you’ve done these three things, then you’ll be ready to buy shares through FNB online banking and the mobile app. So make sure you keep reading, I’ll cover the online banking method first.

How To Buy Shares Through FNB Online Banking

- First go to the FNB login page here. At the top right of the screen, insert your username and password.

- Then click on the menu. It will either be at the top left or left of your screen.

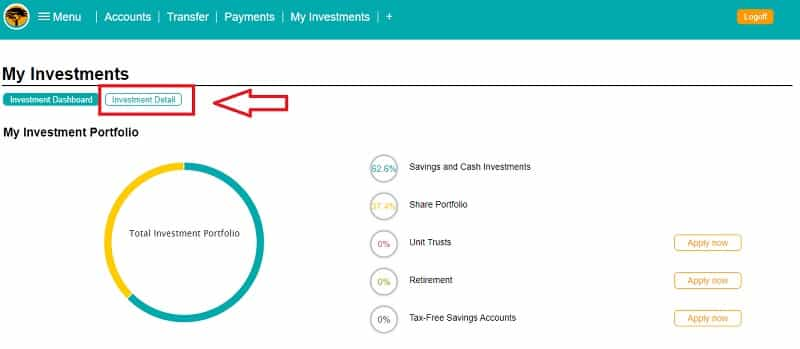

- Then click on “my investments.” You’ll now be within the investment dashboard.

- Click on Investment detail. You’ll be taken to a screen that shows your savings accounts, and your “share portfolio.”

- If there are no accounts below your “share portfolio,” then click on “open share portfolio account.” How to open a share portfolio account is beyond the scope of this article, so if you need help doing that, please go into your local FNB branch.

- If there are accounts under your “share portfolio,” then simply click on the account.

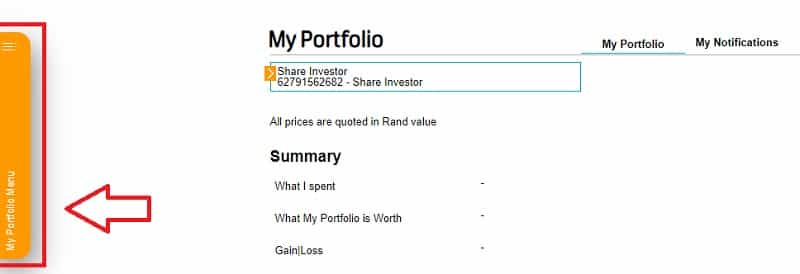

- Click on “My Portfolio Menu.”

- Then once the menu is open, click on “Shares.”

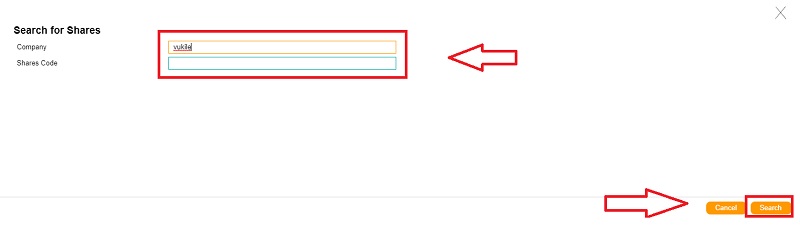

- Search for the company.

- The company should pop up.

- Then click “buy.” Don’t worry, it won’t buy the company straight away, it will take you to the detail screen first.

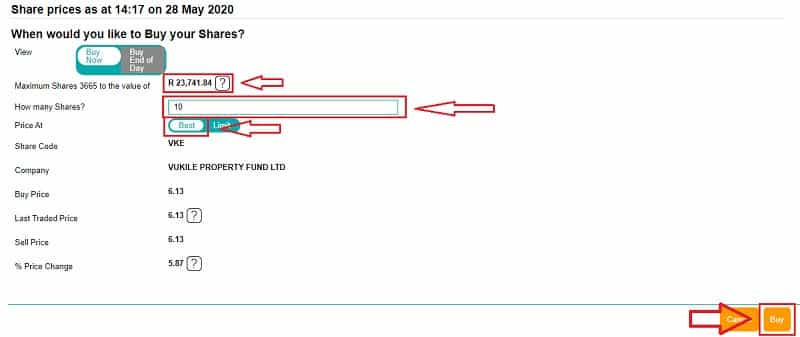

- Right, now you need to select how many shares you would like to buy and the price you’re willing to pay.

- Insert the number of shares you would like to buy. FNB will tell you how many shares you can buy with the money you have in your investment account if you want to get as many shares as possible, choose a number slightly lower than the number they recommend. The reason is so that if you end up paying slightly more per share, your order doesn’t get canceled because of insufficient funds.

- The next option you’ll see is “price at.” Here “best” means you’ll buy the shares at the next available price, and “limit means” you can set a limit for the maximum you’ll be willing to spend on the share. I always select “best.”

- Check over all the details. If you’re happy, click on the buy button at the bottom right of your screen.

- View over the fees and details of the trade, check the box at the bottom left, then finally tap on confirm on the bottom right.

Congratulations, at this point you’ve just completed your first trade. These details will now be sent through to FNB to execute the trade, and you should receive and email once the trade goes through over the next 24 hours.

If your trade doesn’t go through, you either didn’t have enough money in your investment account, or a broker couldn’t find a willing seller for your trade. The fix? Simply try the process again.

How To Buy Shares Through The FNB Mobile Banking App

- Start by opening and signing in to your FNB app.

- On the top left, tap on the hamburger menu, and select “My Investments.”

- Then tap on “investment detail.”

- Tap on your share investor account. If there are no accounts below your “share portfolio,” then click on “open share portfolio account.” How to open a share portfolio account is beyond the scope of this article, so if you need help doing that, please go into your local FNB branch.

- On this screen, you’ll see all your account details like cash available to trade, and total value, etc. Make sure your “available to buy” has some money reflecting.

- Tap on “trade” on the bottom right.

- Choose “Buy Shares.”

- In the search tab, find your stock by either typing in the ticker number or company name. Then tap on the stock that you want to buy.

- You’ll get to the share’s information screen. To buy, tap on the “Buy” button at the bottom right.

- Now it’s time to choose your “price at” option, and how many shares you want.

- As mentioned before, here’s what “price at” means. “Best” means you’ll buy the shares at the next available best price, and “limit means” you can set a limit for the maximum you’ll be willing to spend on the share. I always select “best.”

- Then insert the number of shares you want. Make sure that you don’t go over the “Maximum shares” it recommends for your budget. If you don’t have enough money for the trade then the trade will be canceled.

- Once ready, tap “continue” at the bottom right.

- Check over your details, then tap on “confirm” on the bottom right.

Done! Your trade will now be sent through to FNB to be executed.

How Long Does An FNB Trade Take To Execute?

Share trading happens while the JSE (Johannesburg Stock Exchange” is still open. They’re open Monday through Friday from 09:15 am – 16:40 pm working days.

If you place your trade within the opening hours, then your trade might be executed within a few hours, depending on how quickly your broker can find a seller.

However, if you place your trade outside of working hours, then your trade won’t be executed until the next working day.

Why Your FNB Share Purchase Has Been Rejected

So you submitted your trade, and a few hours later, you get the email as shown below back from FNB.

What do you do?

First, don’t be too concerned! This happens frequently, and it’s usually because of one of two reasons.

- You didn’t have enough funds for the trade. This is the most common reason. Simply go back into your FNB and repeat the process, however, make sure you have enough funds to cover the trade.

- They couldn’t find a buyer at the price limit you requested. When buying shares, you have two “price at” options. “Best,” and “limit.” If you selected limit, then there’s less of a chance that your trade will go through, because the broker has to wait for the price of the stock to reach your set limit price. If you would like to buy the stock now, then go through the process again, and select “Best” pricing option. This will trigger the purchase at the next best available price.

Final Thoughts

Once you’ve used FNB’s share investor account a few times it navigating and using it will become a lot easier. I use it all the time without any issues.

YOUR TURN: Do you know an easier way to buy shares through FNB? Do you feel like I missed something important in this article? Let us know in the comments so we can start learning from each other!

I just opened a share investor account, and didn’t know how to get into the investing part of the app, Until I searched and came across this tutorial that said – the Hamburger at the top, and then go into my investments. Its been all of 5minutes since I joined and the adventure and excitement is quite entertaining.

Thank you for a very good tutorial.

Much appreciated.

thanks for the information: all i want to know ,is that it is safe to buy those shares or its risk .because i don’t want to lose my money

Excuse my very basic and slightly dumb question… After I have purchased the shares, what happens? Do I have to maintain them any how through trading, do I have to monitor markets? I am very clueless about this but I am willing to learn