TWO BIG FACTORS, according to Consulta, that defines a leading bank in the eyes of the customers are how well the banks:

- Treat their customers.

- Reward their customers with hard cash without making the rewards system overly complicated.

That said, which bank is the best in South Africa?

According to data from a Consulta customer survey, Capitec is the best bank in South Africa. Capitec has an overall customer satisfaction score of 84.7%, and a customer loyalty score of 76.7% which is above global benchmarks.

That said, what is the worst bank in South Africa?

According to data from a Consulta customer survey, Standard Bank is the worse bank in South Africa. Standard Bank has an overall customer satisfaction score of 77.7%, and a customer loyalty score of 69.3% which is the lowest in South Africa when compared to five of the other major banks such as Capitec.

Below is a table that breaks down all Consulta customer survey for 6 of the largest banks in South Africa.

In this article, we will look into this data so that we can better understand why customers rate Capitec as the best bank, and how other banks compare.

| Bank | Over All Consumer Satisfaction | Customer Loyalty | Treating Customers Fairly | Complaints Incidence | Complaints Resolution | Net Promoter Score | |

| 1. | Capitec | 84.7% | 76.7% | 86.3 | 11.9% | 55.4% | 56.6% |

| 2. | African Bank | 83.4% | 76.2% | 86.3 | 14% | 59.7% | 50.8% |

| 3. | Nedbank | 81.1% | 73.5% | 82.9 | – | – | 40.8% |

| 4. | FNB | 80.2% | 72.8% | – | 23% | 49.8% | 39.8% |

| 5. | ABSA | 78.6% | 70.4% | – | – | – | 26.9% |

| 6. | Standard Bank | 77.7% | 69.3% | – | 22.5% | 51.9% | 24.4% |

The information above was gathered from a Consulta Poll—polled 12,500 customers—which is extremely helpful when determining the best bank in South Africa.

The poll covered questions to determine:

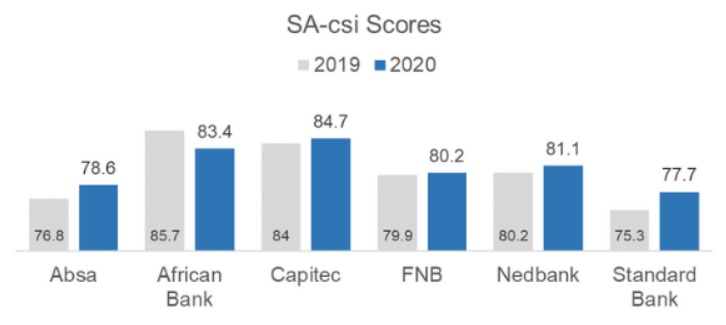

A. Over All Consumer Satisfaction Index (Sacsi) for banking in South Africa 2020:

B. Customer Loyalty

Customer loyalty reveals how likely a customer will be willing to stay with the bank. The higher the customer loyalty rating, the more likely the bank is to do a good job at keeping their customers happy.

C. Treating Customers Fairly

This score shows if customers feel like the bank has treated them fairly or not. An indication of customer support and rewards.

“Banks continue to be poor at preventing repeat causes of complaints and customer dissatisfaction once resolved, which directly correlates with customer loyalty”

Consulta

D. How Likely Is a Bank to Resolve Your Complaint?

This section is designed to look at two things. How many incidents a bank gets, and more importantly, how likely are they to resolve these complaints.

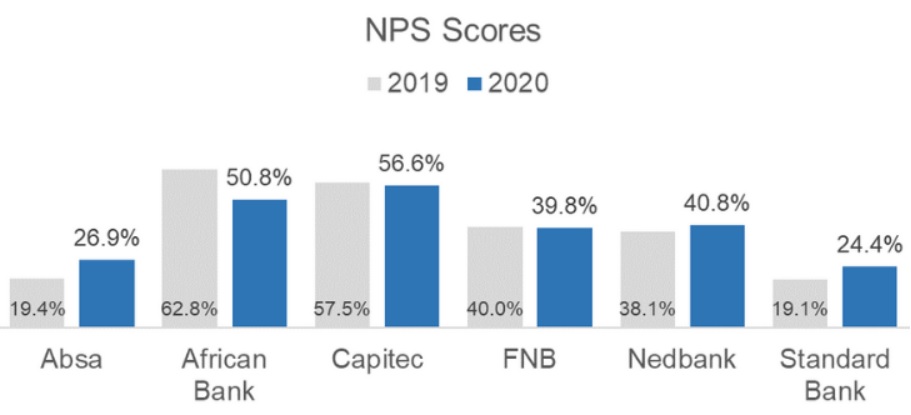

E. NPS score. How Likely People Are Willing To Recommend A Brand To Family Or Friends?

NPS score or also known as net promoter score gives an indication of how likely a person is willing to recommend a bank to family or friends. The higher the percentage, the more likely it is.

Taking all of this information into consideration, here are the top 6 banks of South Africa in 2021:

01. Capitec (Winner)

Capitec in recent years has been making a lot of headway when it comes to satisfying their customers.

In 2020, they not only achieved the highest overall customer satisfaction score of 84.7%, but they also increased that figure from 2019, which shows they keep improving.

On top of that, they beat every other bank in most of the customer rating categories mentioned below.

- Highest loyalty rate of 76.7%.

- Tied with African bank when it came to how they treat their customers at 86.3%.

- Extremely low incident rate of only 11.9%. The lowest out of all 6 banks mentioned here.

- Resolved complaints efficiently and effectively with a second-highest score of 55.4%, just below African bank which has a whopping 59.7% complaints resolution rate.

- Highest NPS score of 56.6%, which means people were more likely to recommend Capitec to their friends and family than any other bank on this list.

To conclude, Capitect seems to be well-liked by their customers and this only seems to be getting better and better year over year.

02. African Bank

African bank came extremely close to claiming the number one spot this year, however, they missed it by the skin of their teeth. Here’s why.

- Complaints incident rate is a lot higher than Capitec. African bank achieved 14%, while Capitec achieved 11.9%. This shows that African Bank customers receive a lot more complaints when compared to Capitec.

- This may indicate why African Bank has the second-lowest NPS score of 50.8%.

- That said, African Bank does a great job at resolving the complaints that they do get. Complaints resolution rate is at 59.7% which isn’t just the highest out of all 6 banks mentioned here, but also well within global benchmarks.

To conclude, even though African Bank didn’t claim the number one spot in the eyes of the consumer, they still seem to be one of the best in South Africa.

03. Nedbank

Even though Nedbank hasn’t achieved the number 1 spot in South Africa, it’s a bank that everyone needs to keep an eye on because it’s one of the fastest growers in the last 5 years when it comes to customer satisfaction.

Nedbank achieved rapid growth in every customer satisfaction category when comparing 2020 to 2019 data. This indicates that the company is on the right track, and is still worth considering.

- Achieved an 81.1% satisfaction rating. This is a 0.9% increase from 2019 which is significant.

- Increased their customer loyalty from 69.4% in 2016 to 73.5% in 2020.

- Increased their NPS score from 38.1% to 40.8%.

If I had to summarize Nedbank in one word, I would say “growth.” Over the past 5 years, they keep improving scores, which means they are more than likely on the right track.

04. FNB

FNB is a disappointing one. Not only because they’re the largest bank in South Africa, but also because I personally bank with them.

To put it plainly, the numbers I’m about to share with you below don’t surprise me at all.

- FNB has one of the lowest overall customer ratings on this list with a score of 80.2%, and declining year over year

- Has the highest complaint rate of 23% and the lowest complaint resolution rate, which is not a great combination. This means FNB is not doing a great job at helping its customers. Which I can attest to.

- The customer loyalty rate continues to rapidly decline from a high of 75,3% in 2016 to 72,8% in 2020.

FNB used to be one of the most loved banks in South Africa, however, over the past 5 years, it seems like they have been slipping significantly.

05. ABSA

ABSA used to be one of the more popular banks when I was young, however, it seems like they’re losing favor by the public.

- The overall customer satisfaction rate of 78.6% is one of the lowest on this list.

- Customer loyalty rate is low at around 70.4%,

- Net promoter score is a low of 26.9%. This means customers are highly unlikely to recommend ABSA to people they know.

06. Standard Bank

At the bottom of the list, we have Standard Bank.

- The overall customer satisfaction rate of 77.7% is the lowest on this list.

- The customer loyalty rate is low at around 69.3%, which shows customers are less likely to stay with Standard Bank when compared to any other bank on this list.

- Net promoter score is a low of 24.4%.

Conclusion

As an FNB customer, I honestly really enjoyed researching and writing this article. I was always under the impression that the bigger the bank, the better it is. But this research really opened my eyes to the better options out there which I will be exploring.

YOUR TURN: Do you know of any other better banks in South Africa that deserve to be on this list? Do you agree with the information I shared? Or do you think I missed a crucial piece of information? Let us know in the comments below so we can start learning from each other!

Hello Kalwyn

Thanks for the article. However I have the following points to make:

I contacted the Capitec link

https://www.capitecbank.co.za/contact-us/

and on that first page it asked whether one wanted to be contacted by phone or email.

I found an email address nowhere (except for merchants).

The second thing was that in listing the identity proof requirements it named SA ID or SA passport (nr), as if they were equivalents, which they are not. This is a big issue, and I wish someone would compare the security requirements of SA banks compared to the best European or UK banks. There are three reasons why I want to move my account to a better bank. One is shocking, insolent and highly inefficient service with 20 emails and the involvement of at least 7 different personnel, none of them taking responsibilities for the communication, before the invovlement of a superioor and a quicck resolution of the problem which all along has been total incompetence (i.e. bad training).

The third issue is the insistence on furnishing a passport number instead of a SA ID number. I am a systems scientist and an ID number is a unique key, partly because it contains the customer’s date of birth, and partly because it is permanent. A passport number is transient and only valid as long as the passport is still valid. Furthermore, passports are forged all the time, as criminals keep up with the security checks embedded in the passport. In addition these checks are only perused when passing in and out of a country – they are not checks that the bank can utilise merely by being given a new passport number, or a verified photocopy of a passport.

The third reason is that over the last prolonged kerfuffle my bank actually had a member of staff try and ask me over the telephone for not just one item but ALL my crucial identification data AND IN FULL, which is an absolute security tabu. Yet the NATWEST bank in the UK has for two decades now had a system of telephone banking in which the bank asks and the customer responds with an randomly chosen isolated number or letter taken from three or four codes only known to the customer and the bank.

Sadly, Capitec does not demand only the SA ID number or a foreign national ID number. Is there any SA bank that does? I live abroad and am strongly considering closing my bank account and ceasing investment transactions with SA.

Thank you for this insightful information. I tend to agree with you on the matter of FNB. I found this article as a result of their poor service.

Been a client for MANY years and recently it seems they are “unknowingly” running transactions outside of business hours, the night before public holidays and even when you paid early, blame you for not paying at all and adjusting your credit score as a result (with the money still in that account) and when you ask them to explain and rectify, all you get is : “you can downgrade your account type…”.

What the F…!?

Due to the threat of online fraud, I store my cash in a separate account and only transfer the monies when it is needed. The problem is, they do not notify you when any transactions arrive or open on your account and when you transfer the monies (in time), they tend to take it; fail the transaction; penalise you for the failure; give you back the money and make it your problem to get the cash manually to the vender.

As we all know that most people to whom that happens will then struggle to send the funds manually, and that results in them using the cashflow. Guess who can help you make it in January?!

Luckily I have had many such failures in the past that forced me to start adding my vendors as beneficiaries, so that It can not happen – again.

I just want to know why my bank pours water on the floor, make me slip and fall on the puddle, clean it up and just walk off stating that nothing happened.

I took them on about this and they, without feedback, just paid back the penalty and it turns out I had money left in the bank confirming I hade enough funds in my account at the time of the transaction.

They send you in-app notifications with banking instructions and communications which tends to disappear conveniently when you try to enforce their communications.

Some staff are willing to help, but it seems their policies are almost made to make you fail, like it has been designed this way, and when you do fail (slip and fall) they are first in line to send you a link on Loans and other ways to “rectify” your mistakes.

What nonsense is this?

I rate FNB at this stage a 2/10 for overall bank satisfaction.

Anyways thank you for the information.

Enjoy the blogging.