Investing can be tricky. You want to grow your portfolio by making the best investment decision possible, but you also don’t want to tie up too much of your capital that you aren’t able to cover your monthly costs. Well, this is where Krugerrands offer the perfect opportunity.

Investing in gold or silver Krugerrands can be an excellent investment because the precious metals used to create them has a secure underlying value that has increased in value for thousands of years. That said, before investing, you need to make sure that you:

- Don’t overpay for Krugerrands.

- Buy Krugerrands at the right time when precious metals are undervalued.

These two factors are crucial to the success of your Krugerrand investment!

That said, keep reading to learn how much you should be paying for each type of Krugerrand, and how I decide when it’s the right time to invest in Krugerrands.

BONUS CONTENT: I covered 10 of the best investments in South Africa in this article, so if you’re looking for other things to invest in, then make sure you check it out.

Let’s get stuck in!

Types Of Krugerrands & How Much They Are Worth

Before I dive into each coin and explain how much they are worth, you need to understand that there are two types of Krugerrands:

- Bullion Krugerrands – usually bought as an investment.

- Proof Krugerrands – bought as a collector’s item.

01. Bullion Krugerrand (Investment)

Bullion Krugerrands was created to make it as easy as possible for investors to invest in the precious metals the coins are made out of. So they’re intended to be used as investments and not as collector’s items. The South African Mint Company makes these coins out of 22 kt Gold, and Silver.

Here’s a table listing all the bullion Krugerrands that are available:

| Type: | Coin weight: | Precious metal weight: | Precious metal type: | Fineness: | Diameter: | Maximum mintage: | Last Checked Price: | Learn More: |

| 1 OZ Gold Krugerrand | 33.1 | 31.1 | 22 kt Gold | 91.67% | 32.77 | 34 | R 36,400 | VIEW |

| 1/2 OZ Gold Krugerrand | 16.1 | 15.6 | 22 kt Gold | 91.67% | 27.07 | 221 | R 20,250 | VIEW |

| 1/4 OZ Gold Krugerrand | 8.5 | 7.8 | 22 kt Gold | 91.67% | 22.06 | 32 | R 11,000 | VIEW |

| 1/10 OZ Gold Krugerrand | 3.4 | 3.1 | 22 kt Gold | 91.67% | 16.55 | 233 | R 4,900 | VIEW |

| 1 OZ Silver Krugerrand | 31.1 | 31.1 | Silver | 99% | 39.00 | 432 | R755 | VIEW |

How bullion Krugerrands are valued? The value of bullion Krugerrands is ultimately determined by the value of precious metals with an added premium for manufacturing costs.

So for example, if gold increases by 10%, your gold Krugerrand will also increase by 10%. It’s important to understand that when you buy these coins, you’re betting on the price of precious metals and not the rarity of the coin.

02. Proof Krugerrand (Collector’s item)

Then you get your ‘Proof’ Krugerrands that was created as more of a collector’s item. These proof coins are manufactured using three different metals; 22 kt gold, silver, and unlike bullion coins, some are even with platinum.

| Type: | Coin weight: | Precious metal weight: | Precious metal type: | Fineness: | Diameter: | Maximum mintage: | Last Checked Price: | Learn More: |

| 50 OZ Gold Krugerrand | 1698 | 1417 | 22 kt Gold | 91.67% | 100mm | 22 | R3,679,279 | VIEW |

| 5 OZ Gold Krugerrand | 169.7 | 141.7 | 22 kt Gold | 91.67% | 50mm | 43 | R299,995 | VIEW |

| 1 OZ Gold Krugerrand | 33.1 | 31.1 | 22 kt Gold | 91.67% | 32.77 | 5000 | R 54,000 | VIEW |

| 1967 1 OZ Gold Krugerrand | 33.1 | 31.1 | 22 kt Gold | 91.67% | 32.77 | 32 | R 44,845 | VIEW |

| 1/2 OZ Gold Krugerrand | 16.1 | 15.6 | 22 kt Gold | 91.67% | 27.07 | 233 | R 28,000 | VIEW |

| 1/4 OZ Gold Krugerrand | 8.5 | 7.8 | 22 kt Gold | 91.67% | 22.06 | 432 | R 15,000 | VIEW |

| 1/10 OZ Gold Krugerrand | 3.4 | 3.1 | 22 kt Gold | 91.67% | 16.55 | 234 | R 7,000 | VIEW |

| 1/20 OZ Gold Krugerrand | 1.7 | 1.6 | 22 kt Gold | 91.67% | 12.00 | 233 | R3,595 | VIEW |

| 1/50 OZ Gold Krugerrand | 0.7 | 0.622 | 22 kt Gold | 91.67% | 8.00 | 32 | R1,928 | VIEW |

| 1 OZ Platinum Krugerrand | 28.4 | 28.4 | Platinum | 99% | 32.69 | 32 | R28,495 | VIEW |

| 1 OZ Fine Silver Krugerrand | 31.1 | 31.1 | Silver | 99% | 32.77 | 32 | R2,495 | VIEW |

| 1 OZ Fine Silver PU Krugerrand | 31.1 | 31.1 | Silver | 99% | 32.77 | 332 | R2,495 | VIEW |

How are proof Krugerrands valued? The value of proof Krugerrands is determined by the rarity of the coin, as well as the value of the precious metal the coin with. Manufacturing and distribution costs are added to the value of the coin as a premium. This premium amount is a set value, while the rarity and the value of the precious metal fluctuate the price of the Krugerrand.

How To Tell The Difference Between Proof and Bullion Krugerrands?

If you’re new to buying Krugerrands, then you’ll need to learn what the difference is between bullion and proof Krugerrands. There are a few shady people out there that will try to advertise bullion coins as proof Krugerrands simply because proof coins are so much more expensive.

So pay attention and learn how to spot the difference before making your first purchase!

There is three key difference you need to look out for:

- Serrations on the edge. You can tell the difference between bullion and proof Krugerrand by counting the serrations on the edge of the coin. Proof Krugerrands have 22 edge serrations, which bullion Krugerrands only have 160 edge serrations.

- Level of detail of the coin. The print on proof Krugerrands also looks a lot more detailed than bullions coins because they are pressed several times with a low weight to make sure the carvings come out as crisp as possible.

- Proof Krugerrands also come encapsulated to keep the coin in the best condition possible.

An important note, there are also a ton of fake Krugerrands in circulation so to avoid getting scammed out of your money, keep reading to find out how you can spot a fake Krugerrand.

How Can You Spot a Fake Krugerrand?

There are several mints and private molders that have attempted to copy the Krugerrand. Their designs are so accurate, that if you’ve never held a Krugerrand in your hand before there’s a high chance that you won’t be able to spot the difference.

The worst part? Today there are thousands of fake Krugerrands in circulation, so make sure you pay close attention to this section to avoid buying a fake.

I researched the best way to spot a fake Krugerrand online and I found this helpful article posted by Pierre, an author over at orobel.biz.

Here’s his article in a nutshell:

- Fake Krugerrands and more yellow than the originals.

- There are fewer details shown on the Springbok’s butt on fake Krugerrands.

- Fewer details on the tail.

- The hoof of the Springbok is flatter and bigger.

- The line is missing on the Springbok’s side.

- Details missing on the horn.

- The coin of the fake is a lot more polished than the original.

Unfortunately the above mentioned method will only work for you if you can get the coin you’re going to buy in your hands before making the purchase.

But what do you do when you buy Krugerrands online?

When buying Krugerrands online, then spotting fake Krugerrand becomes A LOT more difficult. Because they can upload any picture they want and send you something entirely different, then by the time you receive the coins, they’ll already be away with your money.

For this reason, I highly recommend that you only buy from the verified Krugerrand sellers listed towards the end of this article, especially if you’re a first-time buyer.

But before you go ahead and start buying up every Krugerrand you can find, I highly recommend you do a bit of research to find out if you should be buying Krugerrands in today’s economic climate.

Keep reading to learn how, i’ll try to make it as simple as possible so stick with me.

When Is The Right Time To Invest In Krugerrands?

So by now, you know you want to buy some Krugerrands, but you’re just not exactly sure if NOW is the right time to be buying them. Here’s how I decide when the right time is.

Before I give you my opinion, a quick disclaimer, I’m legally not allowed to provide you with any investment advice because I’m not your financial adviser. That said, the information that I’m about to share is simply my opinion, so please treat it that way.

With that out of the way, let’s get started.

The technique that I use to decide when to buy Krugerrands is a simple two step process.

- First, I find out if precious metals are currently undervalued compared to the stock market as a whole. This will tell me if I should be buying precious metals in the first place, or if my money would do better in the stock market.

- Then, I find out which precious metal is undervalued the most. Gold or silver? This will tell me if I should buy gold or silver Krugerrands.

Here’s the details of each step.

01. Find out if precious metals are undervalued compared to the stock market.

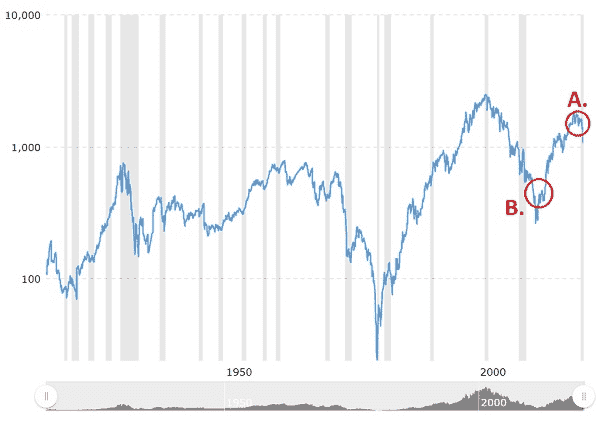

I do this by looking at the macro trend ratio between the Dow Jones Index and precious metals over the past 100 years. This will give me an idea of if I should be buying precious metals at all, or if I should be putting my money in the stock market instead.

In the picture below, you’ll see that historically there’s a trend with two markings on them that indicate two scenarios.

- A. If the ratio trend line is over 1000, then this indicates to me that the stock market is overbought and overvalued. This signals to me that I should either be buying precious metals or selling my stocks and using that money to buy precious metals.

- B. If the trend line is below 600, then this indicates to me that the stock market is undervalued, so my money would probably do better in the stock market when compared to precious metals. In this case, I’ll hold back on buying precious metals. I might even sell some of my precious metals and buy stocks.

CONCLUSION. In this case, we can see the price of precious metals is undervalued compared to the stock market. So as it stands in August 2020, I’ll be comfortable buying precious metals in the form of Krugerrands instead of stocks. Since I believe the stock market is overvalued, I’ll even take it as far as selling some of my stocks, and using that money to buy precious metals.

Which takes me on to the next step.

02. Find out which precious metal is undervalued the most.

Now that we know we’re going to buy Krugerrands, we need to decide if we’re going to buy silver, or gold Krugerrands.

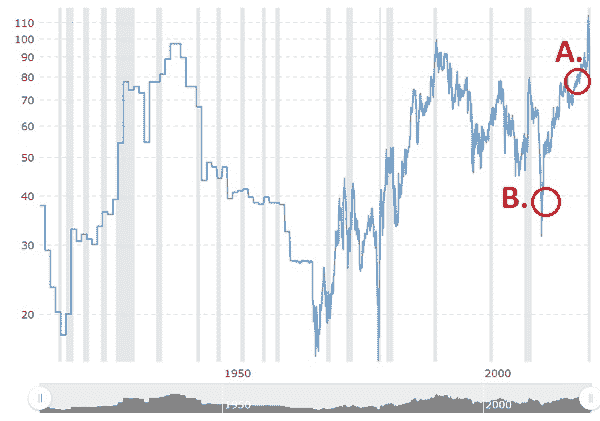

To make our decision, it makes sense to look at the macro trend ratio line again, but this time between gold and silver.

Historically the ratio between gold and silver has swung between 40 and 75. Each swing indicates a different scenario as shown in the image below.

- A. If the ratio line is above 75, then this tells me that silver is undervalued. In this case, I’ll either buy silver Krugerrands, or I’ll sell my gold, and use that money to buy silver.

- B. If the ratio line is below 40, then this tells me that gold is undervalued when compared to silver. In this case, I will either buy gold Krugerrands, or I will sell my silver and use that money to buy gold.

CONCLUSION. As it stands today, on the 12th of August 2020, the ratio is at 77.94, which indicates to me that I could be buying silver Krugerrands.

| Buy stocks or precious metals? | Buy Silver or Gold? | ||

| S&P/Silver ratio above 1000 | Buy precious metals | Silver/Gold ratio above 75 | Buy Silver |

| S&P/Silver ratio below 600 | Buy stocks | Silver/Gold ratio below 40 | Buy Gold |

Now it’s worth mentioning that the window of opportunity for my strategy only comes around every few decades, however, if you have patience and you follow the rules, you could make a really healthy ROI in the long run.

Where to Buy Krugerrands

Right, you know which Krugerrand you’re going to buy, and you think precious metals are undervalued, now it’s time to find out where you should be buying yours from.

There are dozens of places you can buy Krugerrands online however to avoid getting scammed out of your money I highly suggest you only buy through authorized dealers that are approved by the South African Mint and Rand Refinery.

To save you some time I listed their authoized dealers below, so feel free to buy Krugerrands from any of these sources:

First National Bank Share Investor – If you bank with FNB the easiest way to buy Krugerrands is through your share investor account. However, keep in mind they only offer four types of gold bullion Krugerrands. The 1 ounce, 1/2 ounce, 1/4 ounce, and the 1/10 ounce Krugerrands.

Scoinshop.com – Another approved dealer that lets you buy both bullion and proof Krugerrands online. As far as I can tell, they only offer the 1 ounce, 1/2 ounce, 1/4 ounce, and 1/10 ounce Krugerrands.

Apart from the approved sources listed above, there’s also a lot of people on online market places. Here are some of the more commonly used platforms:

- Bidorbuy

- Takealot.com

- Gumtree

- FB Market Place

- OLX

- Local Coin Shows – Check this FB group to see upcoming shows near you.

- Junk Mail

The only drawback with these platforms is you’re opening yourself to the chance of getting scammed. So if you do decide to use them PLEASE be as careful as possible.

Make sure you’re buying from verified buyers, and if you’re using Gumtree, FB marketplace or any platform where you have to meet the person, make sure you set up the meeting in a busy spot that you’re familiar with and take a friend or family member with you.

Where to Sell Krugerrands

Selling Krugerrands is a lot less risky and usually involves using one of the unverified market place platforms I mentioned above.

- Bidorbuy

- Takealot.com

- Gumtree

- FB Market Place

- OLX

- Local Coin Shows – Check this FB group to see upcoming shows near you.

- Junk Mail

If you’re setting up a meeting with someone, make sure you do so in a busy and familiar place, like a restaurant to avoid getting robbed. Also, it’s a great idea to take someone you know with you, especially if you’re a woman.

Do Krugerrands Have A Face Value?

The silver bullion Krugerrand has a face value of R1. That said, all other Bullion and Proof Krugerrands don’t have a face value. The cost of the coins comes from the gold, silver, or platinum content in the coin. Since precious metals are so volatile, the value of the coins can increase and decrease dramatically over a few months.

However, generally speaking, precious metals historically always increase in value because of inflation and other factors that increase the perceived value of these metals.

Final Thoughts

Krugerrands can be a great investment as long you remember follow these key points.

- Don’t fall into the trap of overpaying for your Krugerrands. You can do this by knowing the difference between Bullion and Proof Krugerrands, as well as how to spot fake Krugerrands.

- Buy your Krugerrand’s at the right time. First, find out if precious metals are undervalued, and then buy the Krugerrand that is made out of the precious metal that is the most undervalued.

If you follow these two basic rules, then you can’t go far wrong.

YOUR TURN: Have you invested in Krugerrands in the past and made a decent profit? Do you have any tips you can share with anyone reading this article? Let us know in the comments below so we can start learning from each other!

I would like to learn more about gold and silver investment, before I started buy it. Please help me, my email is sibonison784@gmail.com.

Is Kew coin recommended to purchase from?

Are Proof Krugerrands currently undervalued ?